Let’s face it, folks—checks might seem old-school, but they’re still a crucial part of our financial lives. Whether you’re paying bills, sending money to family, or even buying a car, Chase check books are here to save the day. But let’s be honest, not everyone knows how to navigate this whole check-writing business like a pro. That’s where we come in. In this article, we’re breaking down everything you need to know about Chase check books—how to order them, manage them, and make the most out of them.

Let’s rewind for a second. Remember the days when cash was king and credit cards were just starting to take off? Checks were the go-to method for big payments, and they haven’t gone anywhere. Chase check books are still one of the most reliable ways to handle your finances, especially if you’re dealing with businesses or individuals who prefer traditional payment methods. And hey, if you’re new to the world of checks, don’t worry—we’ve got you covered.

Now, before we dive deep into the nitty-gritty, let’s clear the air. This isn’t just another boring guide. We’re here to make sure you understand Chase check books inside and out, from ordering them to avoiding common mistakes. So grab a coffee, sit back, and let’s get started on this financial journey together. Oh, and don’t forget to bookmark this page—you’ll want to refer back to it later!

Read also:Christopher Masterson A Journey Through Acting Family And Legacy

What Are Chase Check Books?

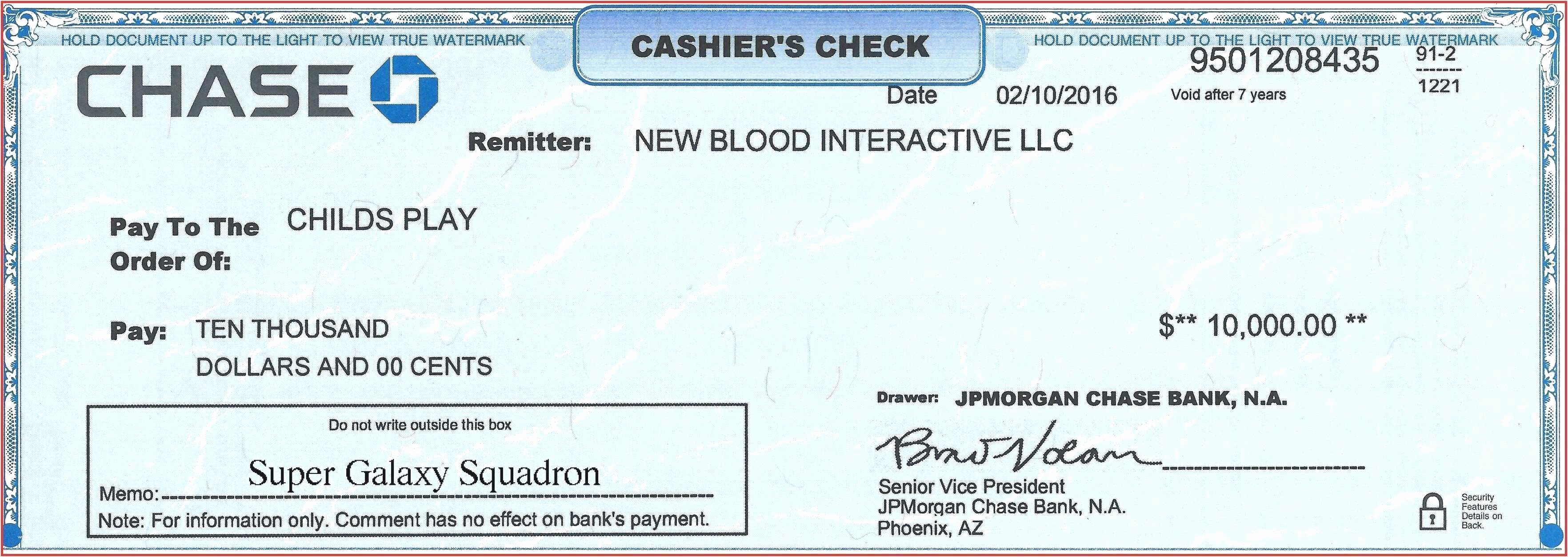

First things first, what exactly are Chase check books? Simply put, they’re a collection of pre-printed documents that allow you to make payments directly from your Chase bank account. Think of them as personalized IOUs that carry a lot more weight than a simple handshake deal. Each check includes your personal details, like your name and address, along with your account number and routing number, making it easy to verify and process payments.

Here’s the kicker—Chase check books come with a few perks. For starters, they’re designed to match your account details perfectly, ensuring security and accuracy. Plus, they’re easy to order and manage through Chase’s online platform, which is a huge win for tech-savvy folks like us.

Why Should You Use Chase Check Books?

Now, you might be wondering, “Why bother with checks when there are so many digital payment options out there?” Fair question. But here’s the deal—checks still hold their own in certain situations. For one, they’re ideal for large payments, like rent or tuition, where you need a paper trail. Plus, they’re accepted by pretty much everyone, unlike some digital payment methods that might leave you scratching your head.

Here’s a quick rundown of why Chase check books are worth considering:

- Secure and reliable for big transactions

- Accepted almost everywhere

- Easy to track through Chase’s online banking system

- Great for situations where digital payments aren’t an option

How to Order Chase Check Books

Alright, let’s talk about the fun part—ordering your very own Chase check books. It’s easier than you think, and you don’t even have to leave your couch. Chase offers two main ways to order checks: through their online platform or by visiting a branch. Let’s break it down.

Ordering Online

Step one: Log in to your Chase account. Step two: Head over to the “Order Checks” section. Step three: Choose the design and quantity you want. Boom, done. Chase will take care of the rest, and your checks will show up at your doorstep in no time. It’s that simple.

Read also:Petey The Cat Dogmans Feline Hero Of The Graphic Novel World

Ordering at a Branch

If you’re more of a hands-on person, you can always visit your local Chase branch. Just bring your ID, and the friendly folks there will help you place your order. Bonus points for face-to-face interaction, right?

Managing Your Chase Check Books

Once you’ve got your Chase check books in hand, it’s time to learn how to manage them like a pro. Here are a few tips to keep things running smoothly:

- Keep Track of Your Checks: Use Chase’s online banking platform to monitor which checks have been cashed and which ones are still out there.

- Secure Your Checks: Treat your checkbook like the valuable document it is. Don’t leave it lying around—store it in a safe place.

- Double-Check Details: Before you sign a check, make sure all the info is correct. Mistakes happen, but they’re easier to fix if you catch them early.

Common Mistakes to Avoid

Let’s face it, even the best of us make mistakes when it comes to checks. But hey, that’s why we’re here—to help you avoid those embarrassing moments. Here are a few common blunders to watch out for:

- Forgetting to sign the check

- Not writing the correct date

- Making the check payable to “Cash” (yep, it’s a bad idea)

- Not keeping a record of the checks you’ve written

Security Features of Chase Check Books

Security is a big deal when it comes to checks, and Chase knows it. That’s why their check books come equipped with a bunch of cool features to keep your info safe. From watermarks to security inks, these babies are built to withstand fraud attempts. And if you ever lose your checkbook, don’t panic—Chase has a quick and easy process for reporting it and getting a replacement.

What Happens If Your Checkbook Gets Stolen?

First off, don’t freak out. Call Chase immediately and let them know what’s going on. They’ll freeze your account and issue a new checkbook with updated numbers. It’s a bit of a hassle, sure, but it’s nothing a little patience and a phone call can’t fix.

Cost of Chase Check Books

Alright, let’s talk money. How much do Chase check books cost, anyway? The good news is, they’re usually pretty affordable. Chase offers a range of pricing options depending on the design and quantity you choose. And if you’re a long-time customer, you might even qualify for some sweet discounts. Keep an eye out for those!

Alternatives to Chase Check Books

Of course, Chase isn’t the only game in town. If you’re exploring other options, there are plenty of third-party check printing services out there. Just make sure they’re legit and offer the same level of security as Chase. Oh, and don’t forget to compare prices—sometimes you can score a better deal elsewhere.

Future of Checks

So, where do checks fit into the future of finance? While digital payments are definitely on the rise, checks aren’t going anywhere anytime soon. They’re still a trusted and reliable method for handling large transactions, and as long as businesses and individuals keep accepting them, they’ll remain relevant. Chase check books are here to stay, folks.

Conclusion: Your Chase Check Book Adventure

And there you have it, folks—a complete guide to Chase check books. From ordering to managing, we’ve covered everything you need to know to make the most out of this financial tool. Remember, checks might seem old-school, but they’re still a vital part of our financial ecosystem. So whether you’re paying rent or buying a car, Chase check books have got your back.

Now, here’s the fun part—what do you think? Have you used Chase check books before? Any tips or tricks you’d like to share? Drop a comment below, and don’t forget to share this article with your friends. Knowledge is power, and the more we spread the word, the better off we all are. Cheers to smart financial moves!

Table of Contents

- What Are Chase Check Books?

- Why Should You Use Chase Check Books?

- How to Order Chase Check Books

- Managing Your Chase Check Books

- Common Mistakes to Avoid

- Security Features of Chase Check Books

- Cost of Chase Check Books

- Alternatives to Chase Check Books

- Future of Checks

- Conclusion: Your Chase Check Book Adventure